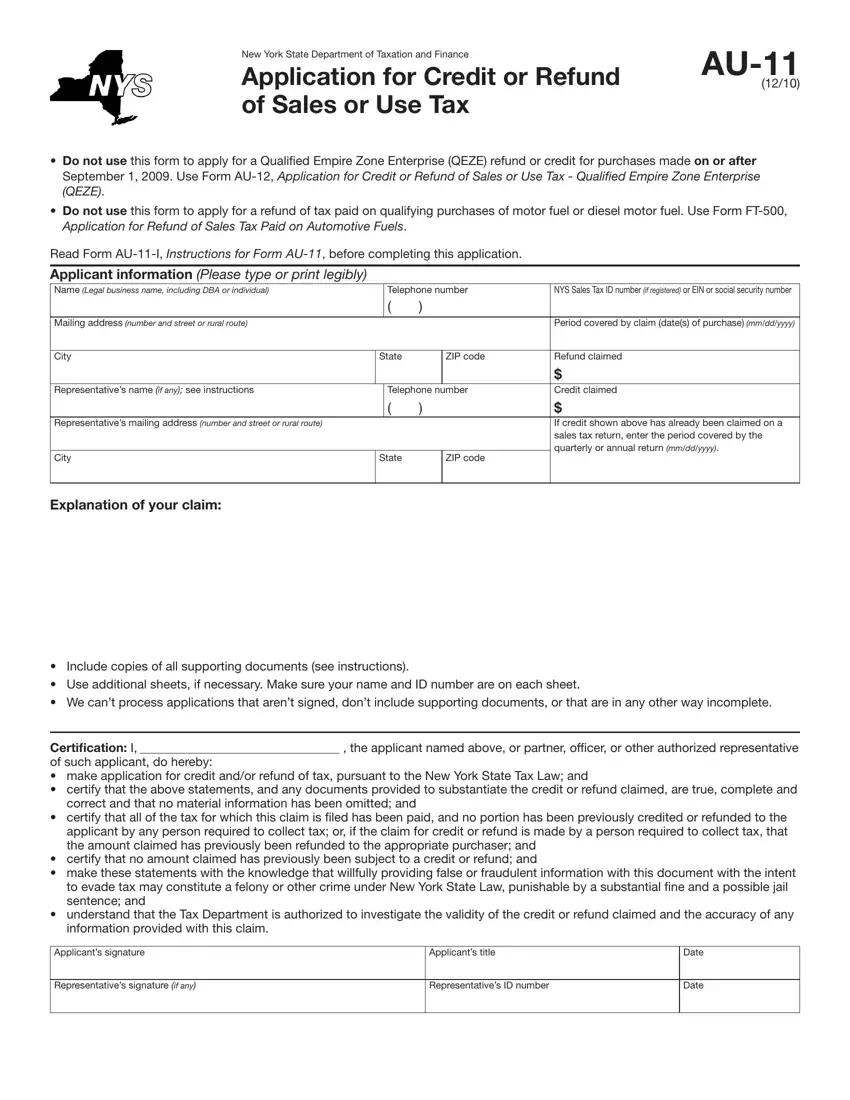

New York State Department of Taxation and Finance |

AU-11 |

|

Application for Credit or Refund |

(12/10) |

of Sales or Use Tax |

|

•Do not use this form to apply for a Qualiied Empire Zone Enterprise (QEZE) refund or credit for purchases made on or after September 1, 2009. Use Form AU-12, Application for Credit or Refund of Sales or Use Tax - Qualified Empire Zone Enterprise (QEZE).

•Do not use this form to apply for a refund of tax paid on qualifying purchases of motor fuel or diesel motor fuel. Use Form FT-500, Application for Refund of Sales Tax Paid on Automotive Fuels.

Read Form AU-11-I, Instructions for Form AU-11, before completing this application.

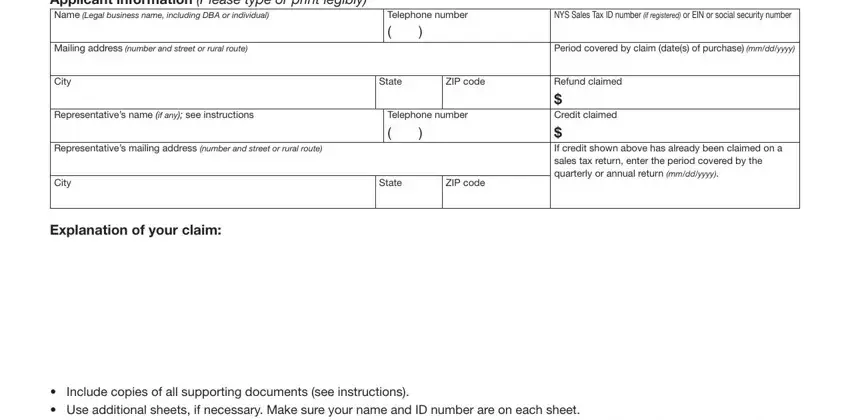

Applicant information (Please type or print legibly)

Name (Legal business name, including DBA or individual) |

|

Telephone number |

NYS Sales Tax ID number (if registered) or EIN or social security number |

|

|

( |

) |

|

|

|

|

|

|

|

|

Mailing address (number and street or rural route) |

|

|

|

|

Period covered by claim (date(s) of purchase) (mm/dd/yyyy) |

|

|

|

|

|

|

City |

State |

|

ZIP code |

Refund claimed |

|

|

|

|

|

$ |

|

|

|

|

|

Representative’s name (if any); see instructions |

|

Telephone number |

Credit claimed |

|

|

( |

) |

|

$ |

Representative’s mailing address (number and street or rural route) |

|

|

|

|

If credit shown above has already been claimed on a |

|

|

|

|

|

sales tax return, enter the period covered by the |

|

|

|

|

|

quarterly or annual return (mm/dd/yyyy). |

City |

State |

|

ZIP code |

|

|

|

|

|

|

|

Explanation of your claim:

•Include copies of all supporting documents (see instructions).

•Use additional sheets, if necessary. Make sure your name and ID number are on each sheet.

•We can’t process applications that aren’t signed, don’t include supporting documents, or that are in any other way incomplete.

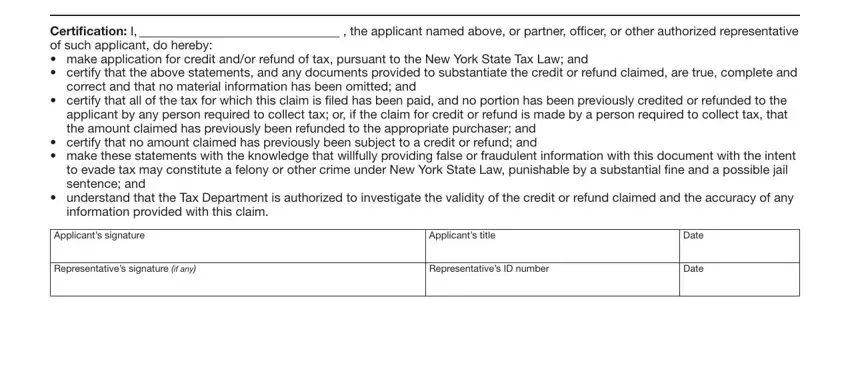

Certification: I, |

|

, the applicant named above, or partner, oficer, or other authorized representative |

of such applicant, do hereby:

•make application for credit and/or refund of tax, pursuant to the New York State Tax Law; and

•certify that the above statements, and any documents provided to substantiate the credit or refund claimed, are true, complete and correct and that no material information has been omitted; and

•certify that all of the tax for which this claim is iled has been paid, and no portion has been previously credited or refunded to the applicant by any person required to collect tax; or, if the claim for credit or refund is made by a person required to collect tax, that the amount claimed has previously been refunded to the appropriate purchaser; and

•certify that no amount claimed has previously been subject to a credit or refund; and

•make these statements with the knowledge that willfully providing false or fraudulent information with this document with the intent to evade tax may constitute a felony or other crime under New York State Law, punishable by a substantial ine and a possible jail sentence; and

•understand that the Tax Department is authorized to investigate the validity of the credit or refund claimed and the accuracy of any information provided with this claim.

Applicant’s signature |

Applicant’s title |

Date |

|

|

|

Representative’s signature (if any) |

Representative’s ID number |

Date |

|

|

|